South San Francisco, CA January 29, 2015

by Amy Hebert Consumer Education Specialist, FTC

Another tax scam: IRS imposters

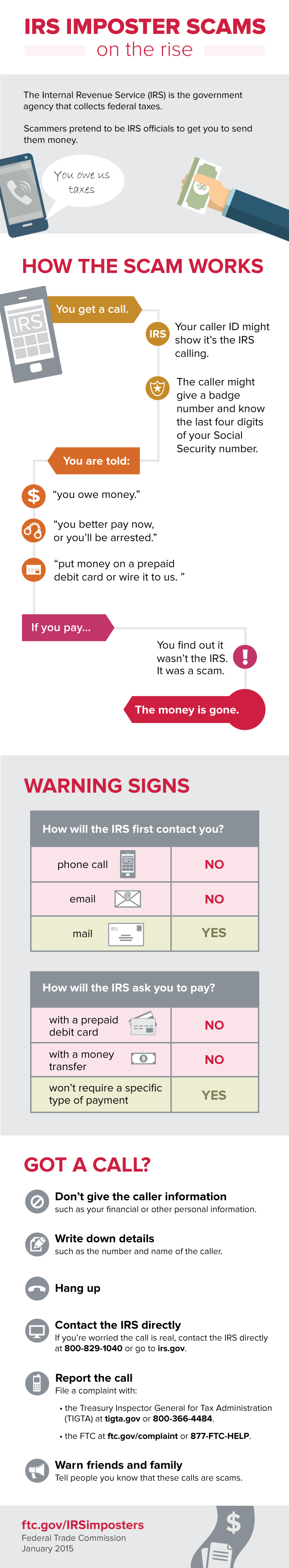

Tax identity theft is the theme of the week, but it’s not the only tax scam we’re talking about. Complaints to the FTC about IRS imposter scams have shot up over the last year — by almost 50,000 complaints.

Here’s what happens: You get a call from a scammer pretending to be with the IRS, saying you’ll be arrested if you don’t pay taxes you owe right now. You’re told to wire it or put it on a prepaid debit card. They might threaten to deport you or say you’ll lose your driver’s license. Some even know your Social Security number, and they fake caller ID so you think it really is the IRS calling.

But it’s all a lie. If you send the money, it’s gone.

When you have a tax problem, the IRS will first contact you by mail. The IRS won’t ask you to wire money, pay with a prepaid debit card, or share your credit card information over the phone.

If you get a call like this, file a complaint with the Treasury Inspector General for Tax Administration at tigta.gov. You also can file a complaint with the FTC at ftc.gov/complaint. If you’re concerned there’s a real problem, call the IRS directly at 800-829-1040.