South San Francisco, CA April 15, 2020 by SSF Resident, Nicole Loza, Law offices of Tom Ratanavaraha

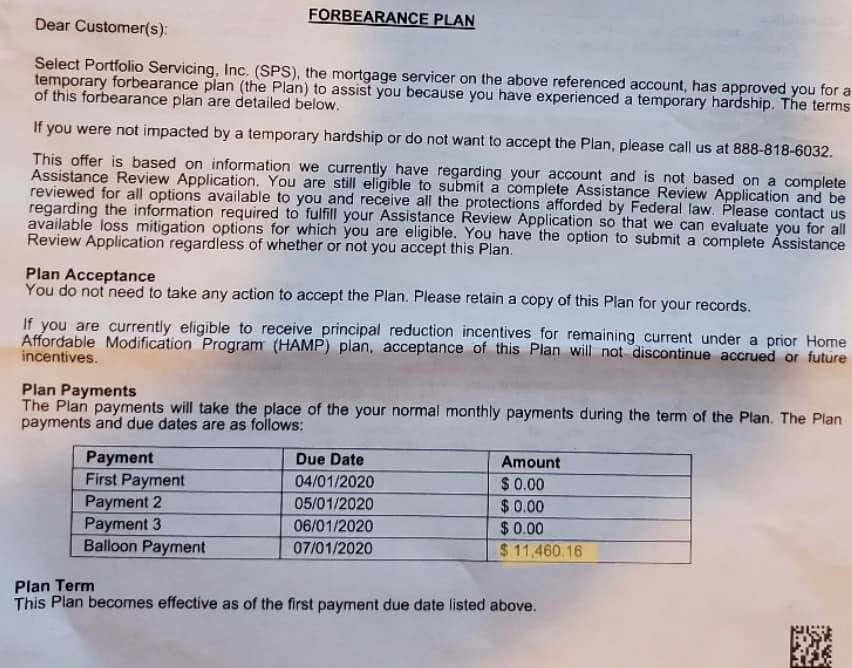

At this time the banks are offering forbearance plans if people can’t pay their mortgage. What these plans basically say is that for the next 3-6 months you don’t have to pay your mortgage and you won’t have to pay interest or penalties.

Although this sounds like a great solution right now, when the plan is over the homeowners will have to pay everything that is owed all at once. If people can’t afford to pay their mortgages right now, there’s no way they have enough saved, or will be able to earn enough once back at work, to make that lump sum payment.

What I expect to see the banks do when this is all over, is offer people who took forbearance plans repayment plans, which will consist of people having all of their arrears spread out over a 6-12 month period, and that amount will be put on top of their monthly mortgage payments. I suspect that most people won’t be able to afford that either.

If you have concerns, please feel free to reach out to me, and let’s see what we can do. You can reach me by email nicole@tomrlaw.net, or by phone 650-340-0204

BRE# 01774289