South San Francisco, CA July 28, 2020 by Samantha Green, Guest Contributor

Teaching your children about financial literacy should be done sooner than you think. Research shows that most children’s financial habits, such as self-monitoring, are set by the time they turn seven.

This means you can start teaching them about financial literacy and introducing them to helpful tools like chores & allowance app for kids by the time they are in second grade.

A study conducted by Washington University in St. Louis indicated that kids with savings accounts to their names—regardless of the amount that’s in the savings account—are six times more likely to go to college than those who don’t.

Another complementary study also revealed that children with savings accounts under their names are also four times more likely to own stocks as young adults compared to those who don’t.

These statistics indicate that the sooner children learn about financial literacy, the more equipped they will be to manage their finances in adulthood properly. When teaching children about financial literacy, the primary goals should be to make it as easy and fun as possible.

Not every child learns the same way, so you need to tailor your techniques to fit the child’s needs. It is also essential that you keep the child interested and engaged so that learning can be impactful.

According to research done by the Williams Group Wealth Consultancy, a staggering ninety percent of wealthy families lose their wealth by the third generation. Children will someday make financial decisions that can impact their future, and teaching them as early as possible can help ensure they don’t become a part of the statistics.

Regardless of where someone is on the socioeconomic spectrum, they need financial literacy to attain financial independence. If children are not taught about financial literacy early, you’ll be handicapping their ability and hurting their chances of becoming financially successful in the future.

###

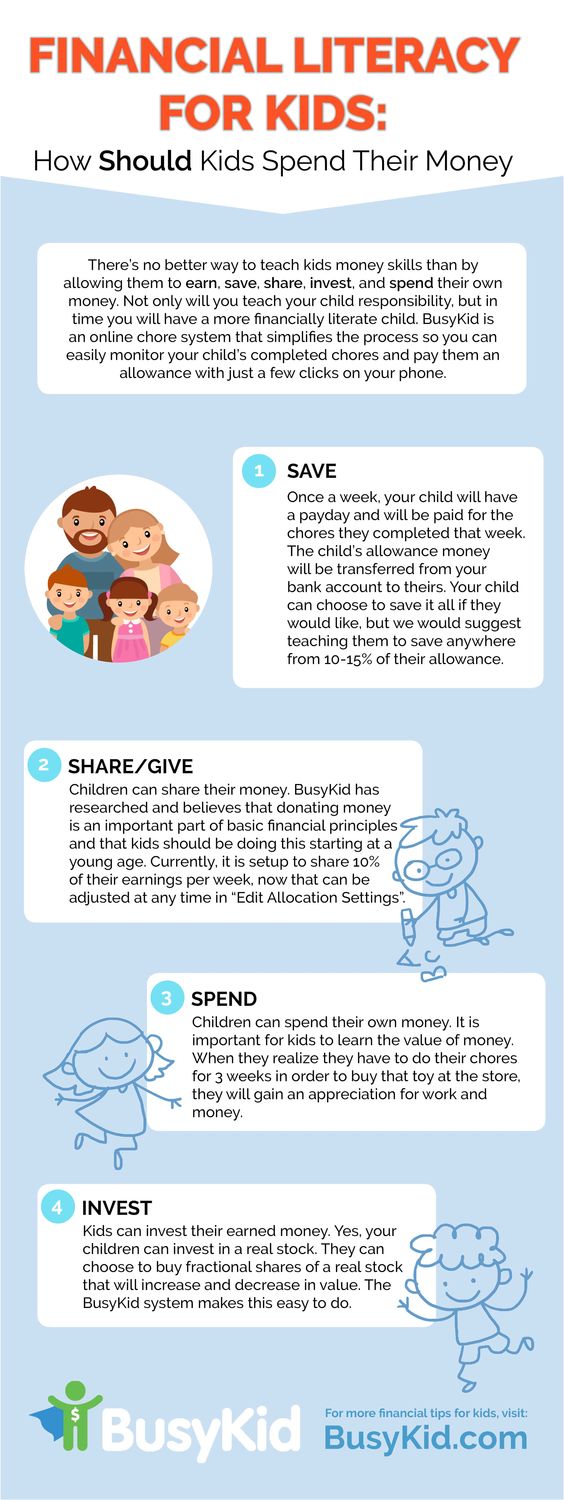

Samantha Green is the Content Marketing Strategist for the MCA award-winning app, BusyKid, the first and only chore and allowance platform where kids can earn, save, share, spend, and invest their allowance. A mom of two, she enjoys spending time with her kids and reading books to them.

**Edit 7.29.2020 11am Graphic added