South San Francisco, CA September 16, 2020 Submitted by SSF Chamber of Commerce

More resources offered by the City of South San Francisco to assist during this unprecedented shelter in place

The City of South San Francisco is committed to supporting our local business community during this unprecedented economic disruption. The City is actively coordinating with other government agencies to connect your business to the most up-to-date information and programs developing. We are here to support your business get through COVID-19.

- Commission Cap on Food Delivery Services

- Resources for Local Artists

- Employers Hiring

- Best Social Distancing Practices for Employers

- Shelter-In-Place Order

- City Tax Relief

- Eat in South City – Who Is Open & Ways to Promote

- Restaurant Support Services

- Loan & Grant Programs – COVID-19

- Business Assistance Recorded Webinars

- County-wide Business Resources

- Unemployment Insurance

- Employers Hiring

- State COVID-19 Website

- Contact us via email

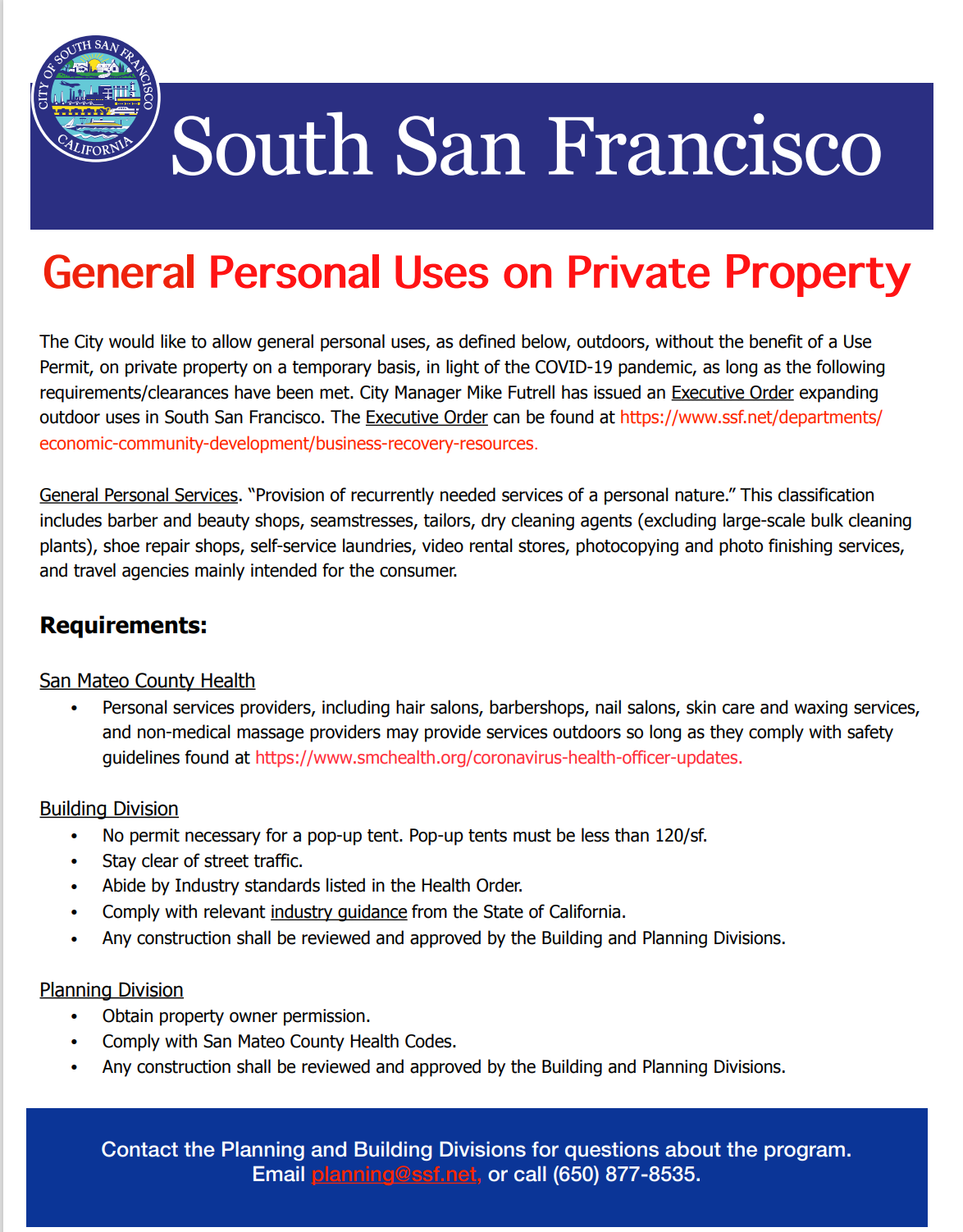

| Outdoor Dining Program and Personal Care Services

South San Francisco restaurants can now apply for a temporary permit that would allow additional outdoor space to accommodate for outdoor dining.

Contact the Planning Division for questions about the pilot program or assistance in applying. Email planning@ssf.net, or call (650) 877-8535.

Small Business Relief Fund

Small businesses in South San Francisco have an opportunity to apply for forgivable micro loans, for either $10,000 or $15,000. Businesses that meet preliminary eligibility criteria will be selected through a lottery to be considered for a loan. The City has appropriated $650,000 of its federal Community Development Block Grant for the Relief Fund, meaning roughly 50-55 South San Francisco businesses will secure a loan. Program Details

Is your business eligible? Businesses must be able to meet each criteria:

|

Small Business and Nonprofit Evictions Suspended due to COVID-19

The COVID-19 public health crisis is expected to continue causing serious negative impacts on South San Francisco businesses. Financial impacts include loss of household or business income, or extraordinary out-of-pocket medical expenses.

Information for Small Business and Nonprofit Tenants

On April 8, 2020, the South San Francisco City Council adopted an urgency ordinance suspending small business and nonprofit evictions due to non-payment of rent, where the cause is loss of income due to the COVID-19 pandemic.

This suspension expired August 31, 2020. The Ordinance describes repayment information, found under Section 3(e). Tenants will be required to pay back any rent owed after the suspension ends.

Ordinance on Temporary Moratorium on Commercial Evictions

Health Order Information

Dial 2-1-1 from any phone to connect with a live operator for the most updated information on COVID-19 affecting your business, or text “CORONAVIRUS” to 211211.

The State has created a website with the updated re-opening plan per county, at www.covid19.ca.gov/safer-economy.

- Shelter-In-Place FAQs

- County Social Distancing Protocol Template (Spanish, Chinese, Tagalog)

- County Health Website

- Signage for businesses on face covering (Version 1, Version 2, Version 3)

- Recorded Video – Business Town Hall – June 30, 2020

- Recorded Video – Business Town Hall – May 20, 2020 – FAQ

- State’s COVID Website

Support Local SSF Restaurants

Commission Cap on Food Delivery Services

On August 26, 2020, the City Council approved temporary emergency legislation to limit the commission that third-party food delivery companies can charge restaurants during the COVID-19 pandemic.

Emergency Legislation Provisions:

- The emergency legislation imposes a commission cap of 15% of the order subtotal for deliveries and 10% of the order subtotal for pick-ups.

- The commission cap will expire six months after the end of the local health emergency, unless extended by the City Council.

- The legislation also prohibits the third-party delivery services from reducing the pay, including tips, paid to any of their delivery drivers because of the commission caps.

Program Overview (Spanish, Tagalog Chinese)

Download a list of SSF Restaurants Open for Take-Out, Delivery, and Outdoor Seating

Download a list of SSF Grocers Open

Local restaurants have been greatly affected by the temporary closure, but many are still open for take-out orders or deliveries only. Please remember to practice social distancing by keeping a six-foot distance between people if ordering by Take-Out.

Want to support our local restaurants? Purchase gift cards to your favorite restaurants below, or contact the restaurant directly:

- Are you an open restaurant that hasn’t been listed in the SSF Restaurant List? Contact us to be added.

- Recorded Webinar (3/20/20) – New ABC regulations on alcohol sales to-go for restaurants

- The California Department of Alcohol Beverage Control (ABC) has issued some temporary regulatory relief related to the sale of alcohol sales (take-out & delivery) for restaurants. ABC has set up a COVID-19 page at www.abc.ca.gov/law-and-policy/coronavirus19/. Subscribe to future updates to these regulations.

- Reach out to the City’s Business Recovery Team.

Business Loan Programs – COVID – 19

SBA Disaster Loan Program (Download overview)

U.S. Small Business Administration is now accepting applications for low-interest federal disaster loans for working capital (Economic Injury Disaster Loans) for small businesses and private, non-profit organizations in South San Francisco to help alleviate economic injury caused by the Coronavirus (COVID-19). Businesses with facilities located in South San Francisco are now eligible.

The three-step disaster loan process provides low-interest, long-term disaster loans to businesses of all sizes, private non-profit organizations, homeowners and renters.

Step 1: Apply for the Loan

Step 2: Property Verified and Loan Processing Decision Made

Step 3: Loan Closed and Funds Disbursed

What can I use the loan for?

The loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact.

What is the interest rate?

The interest rate is 3.75 percent for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75 percent. SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

Is there a maximum?

Federal law limits these to $2,000,000 maximum for alleviating economic injury caused by the disaster, and the actual amount of each loan is limited to the economic injury determined by SBA, less business interruption insurance and other recoveries up to the administrative lending limit. SBA also considers potential contributions that are available from the business and/or its owner(s) or affiliates.

How do I apply?

Click here for more information on how to apply. For additional information, please contact the SBA disaster assistance customer service center at 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail disastercustomerservice@sba.gov or visit www.sba.gov/disaster.

Go to the State Treasurers Office website for more information about the program. Check to see if your commercial lender or financial institution participates in CalCAP or find a participating lender.

Local COVID-19 Lender Programs

San Mateo Credit Union is providing low-rate fixed term loan to provide to those businesses affected by COVID-19. SMCCU’s Work Reduction loan can provide some much needed working capital. The Work Reduction Loan provides a low fixed rate of 6.99%, with a 12-month term, loan amounts equal to two weeks salary, with a quick decision and quick access to cash.

Paypal is offering loans for small businesses between $5,000 and $500,000 for working capital. Approval is quick, sometimes within one working day. More information and details can be found here.

Business Assistance Recorded Webinars

View Recorded Webinars on “Coping with COVID-19” for small businesses only. Available webinars now include:

- How to fill out an application for the SBA Disaster Relief loan

- How to cope with a tight cash flow for your small business with the COVID-19 disruption

- Resources for local restaurants, including temporary changes to ABC regulations for alcohol sales

Small Business Development Center

Through the U.S. Small Business Administration (SBA), small business development centers are available throughout the country to assist with business development, business recovery efforts, and supporting your business. The San Mateo Small Business Development Center (SBDC) services the South San Francisco business community, and is an available resource supporting small businesses.

Download the COVID-19 Small Business Survival Guide.

County-wide Business Resources

The San Mateo County Economic Development Association (SAMCEDA), has compiled a COVID-19 business support website with links to many organizations and agencies that are assisting our local business community.

Additional Resources:

California Labor & Workforce Development Agency (LWDA)

In the face of the coronavirus, the Labor & Workforce Development Agency (LWDA) wants to keep workers, employers, co-workers, and families safe. The LWDA link provides information on paid sick leave, disability and unemployment insurance, paid family leave, workplace health and safety guidance, and other employer assistance.

Employment Training Panel (ETP)

ETP’s goals are to support job creation and retention, through training. ETP is funded by a special tax on California employers and differs from other workforce development organizations whose emphasis is on pre-employment training. ETP fulfills its mission by reimbursing the cost of employer-driven training for incumbent workers and funding the type of training needed by unemployed workers to re-enter the workforce. Overall, the ETP program helps to ensure that California businesses will have the skilled workers they need to remain competitive. Use the link above in the title to determine to access ETP’s resources.

GO-Biz – Governor’s Office of Business and Economic Development

GO-Biz has compiled helpful information for businesses as it relates to Coronavirus (COVID-19). The

- Main Street Lending Program at the US Federal Reserve is the last remaining pool of CARES allocation to be distributed to both small businesses and medium/larger businesses. The Federal Reserve’s Boston branch is the current lead for the program. Lenders are currently signing to deploy Main Street. This program is not live, but will be live any day now. Contact & Stay Up to Date: For constituent institutions, general program inquiries can be directed to MSLP@bos.frb.org. To receive program updates, simply subscribe at the bottom of this web page. Main Street Lending Page: The new MSLP landing page at www.bostonfed.org/mslp contains a great deal of information on the program. Loan Information: Program term sheets, FAQs, reports and associated press releases can be found at this link.

- To offer resources or manufacturing, visit the COVID-19 Supplies Page

- Check out Go-Biz YouTube, where Go-Biz posts recorded webinars and short videos featuring funding and incentives

State Resources for Guidance to Re-Opening

Unemployment Information related to COVID-19

NOVA provides customized services to the jobseekers of Silicon Valley through its job centers in Sunnyvale and San Mateo. NOVA staff are dedicated to providing you with the necessary tools to enter or re-enter Silicon Valley’s unique workforce. Your time at NOVA will begin by speaking with experienced career advisors to discuss your specific needs. Afterward, you will have the opportunity to participate in workshops that focus on such topics as assessing your career objectives, creating a powerful resumé, learning to network effectively, and understanding how to negotiate for the best possible employment situation. And if your skills are out of date, you may have the opportunity to participate in classroom training at no cost with approved local vendors.

NOVA also provides specialized services to specific populations such as veterans, youth, and older workers. NOVA works closely with local businesses, educators, and individuals to ensure that our programs provide opportunities that build the knowledge, skills, and attitudes necessary to address the workforce needs of Silicon Valley. NOVA is an equal opportunity employer/program; auxiliary aids and services are available upon request to individuals with disabilities.

Employment Development Department (EDD)

The EDD provides a variety of support services to individuals affected by COVID-19 in California. The EDD link above provides information for employers on Workplace Health and Safety, Reduced Work Hours, Potential Closure or Layoffs, Tax Assistance, and other resources.

Sick or Quarantined

If you’re unable to work due to having or being exposed to COVID-19 (certified by a medical professional), you can file a Disability Insurance (DI) claim. DI provides short-term benefit payments to eligible workers who have a full or partial loss of wages due to a non-work-related illness, injury, or pregnancy. Benefit amounts are approximately 60-70 percent of wages (depending on income) and range from $50-$1,300 a week.

The Governor’s Executive Order waives the one-week unpaid waiting period, so you can collect DI benefits for the first week you are out of work. If you are eligible, the EDD processes and issues payments within a few weeks of receiving a claim. For guidance on the disease, visit the California Department of Public Health website.

Employers Hiring

- 7 Eleven

- Allied Universal Event Services at Chase Center – Security Guards

- Amazon Delivers/Whole Foods

- California Staffing Service – Substitute Preschool Teachers, Assistant Teachers and Teacher Aides

- Chajinel Home Care Services – Job Description

- Costco Business Center – Truck Drivers (must have class b license)

- CVS Health

- Dollar General

- Forward Logistics Inc. – Order Entry Clerk, Billing Clerk, Freight Operations Assistant, Class A Driver, Class C Driver

- Good Eggs

- Hatch Realty Group – Full- or Part-time Real Estate Agents

- Instacart

- OnwardCa.org is a new platform connecting COVID-19 displaced workers with over 70,000 job opportunities in critical industries.

- Papa John’s Pizza

- Peninsula Humane Society – Human Resources Assistant, Veterinary Assistant, AR&C Dispatcher, Seasonal Wildlife Rescue Technicians, Adoption Counselors, Animal Care Technician, Animal Control Officer

- Safeway

- Smart and Final

- Target

- U.S. Postal Service

Other Resources

Financial Strategies for Freelancers and Gig Workers During COVID-19

Bankruptcy in America: Tracking Commercial and Personal Filings by State